Collaborative Economy Industry News, Jan 21, 2015

Welcome, this industry newsletter shares key market changes, in a twice-monthly publication, curated by Jeremiah Owyang, Founder of Catalyst Companies™, you can subscribe to the email newsletter on the footer of the homepage.

Crowdfunding Is Growing, a $5 Billion Industry: The sharing economy is an incubator for innovative ideas, but Carly Okyle reminds us that, “A great idea won’t get anywhere without some cash behind it.” According to Okyle, Crowdfunding has become a $5.1 billion industry that raises $2 million each day, yet it still accounts for only 3% of startup funding. The website Fundable.com adds some significant reasons why we can expect the appeal and effectiveness of crowdfunding to grow including that fact that it is more efficient, it increases company exposure, it provides opportunities for investors to critique and collaborate, and it gains early advocates. More insights on crowdfunding are available on Fundable.

Ride-sharing Drivers Have a Place to Go, The Groove: Drivers from Uber, Lyft and Sidecar all have a place to go in San Francisco. A gathering place called Groove has opened at SoMa StrEat Food Park, offering drivers a place to meet, eat, and to go. StrEat Food Park offers permanent service from a variety of food trucks, a heated seating-and-eating area equipped with picnic tables and big-screenTVs, a place to take a nap, and restrooms. Every solution creates problems of its own. This has been exemplified by the ride-sharing sector, even now as the concept of sharing has solved a problem for ride-sharing drivers. See the complete story in the San Francisco Chronicle.

InstaCart and Seamless Find Funding: InstaCart is preparing to raise another $10 million in new funding that will bring their funding total to $220 million. GrubHub raised $190 million in its recent IPO. Part of that funding was channeled to GrubHub’s delivery subsidiary, Seamless. Food-related, sharing-service companies gleaned $1.2 billion from eager investors in 2012. That amount increase by 33% to $1.6 billion last year. According to, more than $260 million was invested into the food tech and media ecosystem in November 2014, with a heavy leaning towards ordering and delivery, particularly in the restaurant space, Food Tech Connect offers additional data.

Juggernaut’s New Approach for Sharing Apps: For every new sharing startup, there has to be an app. Juggernaut has envisioned a better way to provide those apps. The problem is a technical that is as old as computer software itself. Either you spend less money to get an out-of-the-box product or you opt for a pricier custom app. The trade-off is that the cheaper solution typically has fewer options for customization and the custom app may be less flexible. Juggernaut’s IP includes a best-of-both-worlds solution that should be beneficial for on-demand services around the globe. Juggernaut’s approach to on-demand apps is explained at Your Story.com.

The Power of the Customer Is Stronger than Ever: Recently, Vision Critical founder, Andrew Reid, explained that we are now in an age where a single, on-line customer review can cost a company millions of dollar. That’s a far cry from the old method of calling customer service or writing a letter to the CEO, neither of which were often effective. shared four things that companies will have to do to retain customers to compete in the sharing economy. Essentially they need to (in our words) personalize, customize, empower and entertain. All of this is going to become increasingly necessary as competition implements ways to engage customer more effectively. Reid’s in-depth presentation is available at Entrepreneur.

Can Startups Self-Regulate?: Ride-sharing leaders Uber and Lyft are petitioning the California Public Utilities Commission for permission to inspect their own vehicles rather than submitting to the same third-party inspections that the state requires for taxi companies. Their request is based on the reasoning that self-inspection will save time and money. Lyft is also arguing that their independently-owned vehicles have less wear and tear than taxis. Therefore, they do not need the same rigorous inspections. The issue of liability actions arising out of negligence that would point to a lack of regulated, third-party inspections. Read the story in the SF Gate for more details.

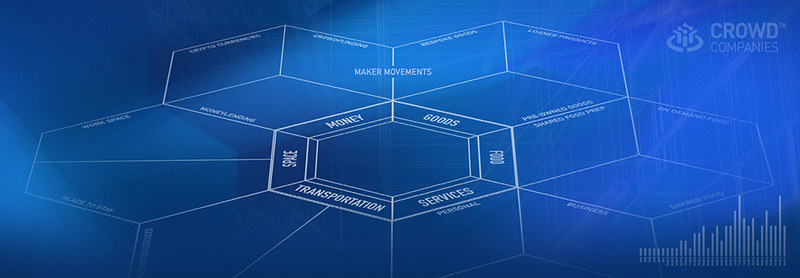

Is the Maker Movement Merely an Enchanting Exchange?: This is the proposition put forward by an assistant professor at the University of Berkeley’s Haas School of Business and another academian from the university’s department of sociology. The authors contend that, “As new ventures within a field become more legitimate and profitable, the field undergoes a process of rationalization and disenchantment: politically- and socially-motivated pioneers are displaced by profit-seeking market actors.” They use the nascent Maker Movement of an example of their socio-economic theory. Their study ultimately offers mechanisms by which startups can retain their initial value sets. The entire 43-page study is available for download at the Social Science Research Network website.